Sunday, March 25, 2018

Defining Deviancy Down

That phrase was coined by the late Sen. Daniel Patrick Moynihan in trying to show that a society has a limit in tolerating bad behavior before it has to start lowering its standards. He also called it “moral deregulation”, that has eroded families, increased crime and produced the mentally ill “homeless” population. The erudite pundit Charles Krauthammer expanded on Moynihan's phrase by proposing the reverse - that not only we were “minimizing what was once considered deviant”, but we were also “finding deviant what was once considered normal”. Since the 1960's, the decline in ethical, moral behavior has steadily declined up the present day where we have behavior that is not only crude in speech, but is dangerous in actions against our fellow man. The disrespect, by some in our society, against our mores and traditions is manifested in the violent crimes that occur all too frequently today in our once safe venues like schools, shopping malls, theaters, houses of worship etc., it is a clear signal that something is amiss in our society today.

Once we take out the “moral purpose” in life, a society cannot remain free and civilized as there will be no constraints and duties required in a fair and just society (ex: the fall of the Greek and Roman societies). Anything goes. Faith, which is condemned in many of our institutions, such as in schools and in government, is not a threat to a civil society, it is vital for its survival, but it is eroding at a fast pace in our screwed up society.

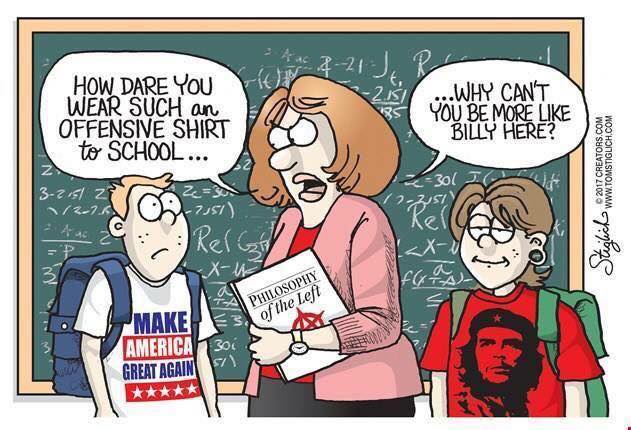

The decline, which started in the 1960's with the passage of the “Great Society” promoted by then President Lyndon Johnson, changed our tenet of self-reliance, to relying on the government to solve most all our problems, a form of socialism that is undermining our capitalist system that is promulgated by most of our professors and educators in our schools. The young people today have been indoctrinated into thinking that our culture and traditions are no longer valid, and that a “total transformation” (a phrase used by former Pres. Obama) is needed to achieve the “Nirvana” that has been pushed into their heads full of mush. Winston Churchill, in his infinite wisdom once said, “If a person is not a liberal (a/k/a Socialist) by the age of 20, he has no heart, but if he's not a conservative (a/k/a Capitalist) by the age of 40, he has no brains”.

Look all around us today. We have taken God out of the schools and replaced it with sex education and free condoms and a “dumbing” down of the curriculum; we have mocked patriotism by banning the pledge of allegiance and national anthem in many of our venues; we have reduced the concept of marriage, which for centuries was designated as between one man and one woman, to be any two (or more) loving people of any sex; we have expanded our welfare rolls, including illegal aliens, thereby making more and more people dependent on government handouts; we have made drug using acceptable , in some cases, while we have made tobacco using unacceptable (a noble gesture); and we have tolerated the total disrespect of the office of the president of the United States while overlooking the crimes of certain favored politicians of a certain party (a double standard of justice).

Today we have groups that shroud themselves in names that connote peace and tranquility, but are actually opposite of what they say they believe, an example being ANTIFA (which stands for anti-fascist). They are the masked thugs that go around disrupting political rallies, and to shut down speakers at forums that they don't agree with, and then join up with another militant group with a sweet sounding sobriquet called BLACK LIVES MATTER. Both of those groups are the antithesis of what their made up names are trying to signify. And, of course, we have the spectra of that insidious term “political correctness” which tries to stifle free speech and free movement by unelected busybodies who try to force their views onto everyone else. A case in point, look what happened at the recent Winter Olympics. For millions of Christians, it is unnerving to live in a world where the sister of a despot (she is the Communication Minister of North Korea) is normalized and glamorized, but a man of faith (V-P Mike Pence) is considered “mentally ill”. That comment was made by Joy Behar on that left-leaning show called “The View”, to laughter and applause by the audience. How low can you go.

All these examples I've listed above, seem to justify, unfortunately, what Sen. Moynihan and Charles Krauthammer tried to convey about what is happening in our society today, and not for the better. It is a case of “Defining Deviancy Down”.

Conservative commentary by Chuck Lehmann

What If Parkland Kids Cared More About Saving Lives Than Getting On TV?

MRCTV's Brittany Hughes asks the questions that the MSM are afraid to ask.

Thursday, March 22, 2018

One Size Does Not Fit All

It is not a given but a misnomer when I hear the phrase,

we are all created equal.

It doesn't appear true when I see a child in Africa looking

at me with sad eyes and flies swarming all over his face,

from my television, in a bid for donations. Or children born

with silver spoons in their mouth. Or children born fatherless

into an atmosphere of poverty out of ignorance.

Tell the children confined in facilities like the Shriners or

St.Jude's children's hospitals they were born equal.

We are not all attractive or all homely. We don't all have the

same I.Q.s. We don't all have the same talents in sports, or

music, or other activities. Yet Liberals require we all conform

to how they view the world and individuality applies only to

them. The rest of us is just a horde to these elitists.

Traditional conservatism sees each of us individually and

it acts to reward or punish each of us accordingly. A Liberal

will punish the whole group by the act of one, e.g., NRA, or

reward a whole group for the excellence of one, i.e.,

giving a trophy to everyone, whether they come in first or

last.

The elitists carry this further through unions in collective

bargaining when negotiating benefits. Everyone gets an

equal bite of the pie, whether they are productive or dead

wood to the company.

Democrat administrations have been partial to multilateral

agreements in foreign trade and other agreements that have

not been beneficial to our country.

The current President is getting heat for trying to renegotiate

the blunders of the past administration, in treaties and trade,

trying to level the playing field with tariff threats.

This does not mean painting the problem with one paint

brush, but viewing the entire gallery of many canvases in a

unilateral approach and assessing the composition of each

one separately.

Because people are not all the same, so are nations not the

same, and must be evaluated by who they are, in a way so

that we all can live in harmony without losing our identity.

Conservative commentary by George Giftos

Sunday, March 18, 2018

Are Enormous Speaking Fees and Huge Donations Really Camouflaged Bribes?

We all know that taking money by a politician or a government official from someone in order to get a favorable government action, is a felony and is called a bribe. Well, suppose the payment of money is in the form of an enormous speaking fee to a spouse or a generous donation to a certain charitable foundation that a particular politician or government official runs or has an interest in, should that be considered a bribe or a “quid pro quo”? Does that sound like a situation that the Clinton's were involved in?

Suppose Hillary Clinton was elected president, how would she have been able to deal with foreign countries, foreign leaders or oligarchs that have contributed millions of dollars to her spouse, Bill Clinton, and to the Clinton Foundation? Do you think that those countries that have donated millions of dollars to Bill Clinton (and Hillary Clinton after her stint as Secretary of State), and the Clinton Foundation, did so out of the goodness of their hearts or do you think they expected something positive in return for their largess? Is the Pope Catholic? Of course.

If you think about this unholy alliance between donor and donee, many of whom are banned by law from donating to a politician or government official directly, could this be called a clever dodge of the law by circumventing the law already on the books? By paying a large speaking fee to a spouse or donating a huge sum to a charitable foundation, that is operated by the politician or government official, and then getting special favors, could that be called a bribe? Any astute and fair minded person would say that this just doesn't smell right.

Both Bill and Hillary Clinton, over the past 15 years have gone from being broke (which they claimed they were in 2001) to now being worth over $150 million. In addition, the Clinton Foundation is estimated to have around $2 billion in working capital , of which it has been estimated that the Foundation donates about 10% to charities in the U.S. and around the world. How did they make all the money, did they start a successful business, did they sell a product or idea, or did they inherit all those millions of dollars? The answer, of course, is that they sold “access” to the government which they had ties to and money to spend. Many people have claimed that the Clinton Foundation is just a Bill and Hillary “slush fund” used to pay big salaries to cronies, to pay for travel around the world and a host of other non-charitable expenses, including paying for Chelsea's wedding, while the Clinton's have claimed a million dollar charitable donation to the Clinton Foundation on their income tax return. That's like taking money out of one pocket and putting it into the other pocket.

Could you believe that anyone, who was so well connected in policy positions within the government (or being an ex-president as Bill Clinton was) would be worth from $200,000 to $800,000 for a 30 minute speech to various companies and countries within and outside of the United States? What words of wisdom could he possibly have to tell those companies and countries other than deal with me and something good will happen to you. Shouldn't that be called a bribe or a “quid pro quo”? You make the call. And yet you still have the Clinton toadies still making excuses for their shady deals in their quest to become multi, multi millionaires. With all the nefarious deals and practices over the years from Arkansas to Wash. D.C., the Clinton's still are walking free and getting accolades from their fellow Democrats. Those are the same people who are now criticizing Pres. Trump as being corrupt. It seems that whenever the Democrats point the finger at Republicans for illegal practices, they are just pointing out the things they have been doing by themselves over the years.

The Clinton's should follow the advice of the late 5-Star General Douglas MacArthur, by just “fading away” as they have left a stain on America which will last for generations.

Conservative commentary by Chuck Lehmann

Thursday, March 15, 2018

MORT’s meanderings

There is an edifice located on 23rd St.,NW in

Washington, D.C. that is widely known as, ‘The

State Department’. . . it was formed on July 27, 1789, some 229 years

ago and today, employs about 13,000 people and operates in 180 countries

with a budget that is upward of $36 Billion (with a ‘B’) taxpayer dollars. This

Department is charged with the responsibility to advise the President, lead the

nation in foreign policy issues, negotiate treaties and agreements with foreign

entities and represent the United States at the United Nations. A big job.

Washington, D.C. that is widely known as, ‘The

State Department’. . . it was formed on July 27, 1789, some 229 years

ago and today, employs about 13,000 people and operates in 180 countries

with a budget that is upward of $36 Billion (with a ‘B’) taxpayer dollars. This

Department is charged with the responsibility to advise the President, lead the

nation in foreign policy issues, negotiate treaties and agreements with foreign

entities and represent the United States at the United Nations. A big job.

Since the Founders of this nation that included such capable men as George

Washington, Thomas Jefferson, John Adams and Benjamin Franklin to name just a

few, the average level of skill practicing the art of diplomacy on behalf of the USA,

has sadly and unfortunately, declined appreciably. Among the recent, lack-luster

Secretaries of State are two women, the bumbling Madelyn Albright and the

infamously corrupt Hillary Clinton, each of whom added less than nothing to

improve that lineage. Following those unsuccessful acts, we were forced to

endure the blustering, cowardly and spectacularly incompetent presidency of

Barack Hussein Obama, coupled with the dubious aid of his Secretary of State

- the all-time arrogant boob, John F. Kerry. Together, they managed to concoct

and pull off the greatest example of a diplomatic disaster the World has ever

witnessed - the Great Iran Nuclear Surrender & $ Giveaway. It is way beyond

the worst, ever.

Washington, Thomas Jefferson, John Adams and Benjamin Franklin to name just a

few, the average level of skill practicing the art of diplomacy on behalf of the USA,

has sadly and unfortunately, declined appreciably. Among the recent, lack-luster

Secretaries of State are two women, the bumbling Madelyn Albright and the

infamously corrupt Hillary Clinton, each of whom added less than nothing to

improve that lineage. Following those unsuccessful acts, we were forced to

endure the blustering, cowardly and spectacularly incompetent presidency of

Barack Hussein Obama, coupled with the dubious aid of his Secretary of State

- the all-time arrogant boob, John F. Kerry. Together, they managed to concoct

and pull off the greatest example of a diplomatic disaster the World has ever

witnessed - the Great Iran Nuclear Surrender & $ Giveaway. It is way beyond

the worst, ever.

Now, to the utter shock, dismay and extreme discomfort of the Dept. of State’s

career bureaucrats and Foreign Service Officers around the world, they learn that

they’ve been put out to pasture by President Donald J. Trump. ‘The Donald’, who

is universally recognized as the greatest negotiator since the genius diplomat, Ben

Franklin himself, has elected to sidestep the middle-men & middle-women of

‘State’. Current Secty of State Rex Tillerson, led by President Trump, will take on

the direct diplomatic negotiations with the world’s leading bad guys. Guess who

comes out on top after these tussles? I can’t wait for the fur to fly.

career bureaucrats and Foreign Service Officers around the world, they learn that

they’ve been put out to pasture by President Donald J. Trump. ‘The Donald’, who

is universally recognized as the greatest negotiator since the genius diplomat, Ben

Franklin himself, has elected to sidestep the middle-men & middle-women of

‘State’. Current Secty of State Rex Tillerson, led by President Trump, will take on

the direct diplomatic negotiations with the world’s leading bad guys. Guess who

comes out on top after these tussles? I can’t wait for the fur to fly.

Sunday, March 11, 2018

Diversity =s Perversity

The catchword in liberal circles today is the term “diversity”. A few years ago the catchphrases were: affirmative action, racial preferences, and racial and ethnic quotas. Since those terms were not warmly embraced by many in the general public, the “diversity” proponents have latched onto the term “diversity” as a more moderate acceptable term to overcome the negatives that those other terms conveyed.

The term, “E Pluribus Unum”, was and is a traditional motto of the United States that appears on the “Great Seal” and on some of our currency. This motto was never codified by law, but it was the “de facto” motto of the United States until 1956 when the U.S. Congress adopted the phrase “In God We Trust” as the official motto. So, even from the beginning of our democratic republic, the main idea of the founding fathers was “unity” not “diversity”.

No one that I know, decries a person or persons venerating their heritage, their ethnicity or family traditions, in fact, we encourage it, but we all must remember that to be an American, a person must adhere to the traditions, the language (English), the laws (both federal and state) that have made us the pre-eminant country in the world today. Balkanization (the act of being isolated from others in your own community) of the populace is not conducive to a harmonious society. People coming into our country should strive to assimilate into our society and not set themselves apart from other Americans. As the original motto of the U.S. Stated, “E Pluribus Unum” (out of many, one) was propagated by our founders, it was the blueprint for the success of the United States.

Another phrase that points up the fallacy of the concept of “diversity” is the phrase, “United We Stand, Divided We Fall”. Many civilizations in the past have succumbed by not having “unity” as their guiding principle. The fall of the Greek Civilization and the Roman Empire are good examples of countries imploding from within rather than by mostly foreign invasion. Look at our recent history where “disunity” has caused revolt and unrest. The division that existed in Canada, between the English speaking and French speaking provinces, was a major cause of contention among those provinces where, at one time, one part wanted to secede from the country to form their own country. That division has been mitigated in recent years. Also, the division that existed between Protestant Northern Ireland and Catholic Ireland, was a violent separation, which lasted almost 100 years. Tensions are less today, but they still exist. And look at Europe today where “diversity” has been the rule the past decades or so, and now most of the countries are suffering because the immigrants that have migrated to their countries, to create “diversity”, have not assimilated and have caused havoc among the permanent residents. Predictions are that Europe will be no longer Europe the way we know it now, as the immigrant population will become the majority unless a major turnaround can occur. The “diversity” concept has bitten them in the butt big time.

So, the headline of our editorial, “Diversity =s Perversity” (perversity being defined as an action that is counter to what has been expected or desired; being contrary to the norm), should be a wake up call for America to not get caught into the trap of thinking that “diversity” instead of “unity” should be the direction our country should take. Our country is and has been a “melting pot” since its inception, within reason, as previous immigrants, by and large, assimilated into society. As a counterbalance to “diversity”, we should all be united by adhering to the precepts of one language, one constitution, and one rule of laws, as the unifying concept that will continue to make and keep America the greatest country in the world. We should all be Americans, not Irish-Americans, African-Americans, Asian -Americans, German-Americans, Jewish Americans etc., etc., we should all be just plain, good old, patriotic Americans.

Conservative commentary by Chuck Lehmann

Subscribe to:

Posts (Atom)